A new year for Web3 is about to begin again.

The collapse of Terra/Luna and FTX collapse had a significant impact on the market in 2022. Despite the negative news, the Web3 ecosystem has steadily grown.

With Ethereum's Merge, GameFi and entertainment projects like STEPN have expanded to a wider range of regions and users.

As General Partner at Emoote, a Singapore-based global Web3 fund, I, Yuji Kumagai, have been steadily executing investments.

Many of you might wonder, "What kind of projects does the Global Web3 Fund invest in?" However, since I myself am based in Singapore, I rarely have the opportunity to introduce our activities.

So, in this newsletter, I will share "What does Web3 VC invest in?" I hope this information will provide helpful hints to those considering starting a business in Web3.

Table of Contents

1. Consumer Project Concentration: Over 30 Investments

In just over a year, we've executed investments in more than 30 Web3 projects (as of January 15, 2022). People often ask us if we're still investing, despite events like the Terra/Luna collapse and FTX collapse, we continue to invest two projects per month.

The timing doesn't matter for great projects that will flourish in the next wave of innovation in a few years. We believe it's essential to continue investing in a stable position because we believe in the future of Web3.

We broadly categorize consumer-focused Web3 projects into "GameFi," "Entertainment/Media," "Lifestyle," and the portfolio ratio of "Other Web3" is as follows:

Why focus on consumer-oriented projects? The reason is that Akatsuki's mission is "Entertain the world. Resonate with creators." We started Emoote because we believe that "Web3 will play a role in supporting entertainment and creators' activities."

Some of you reading this newsletter may have a strong impression of "Akatsuki = games." Of course, there is no doubt that GameFi is a significant field, but I have always had the hypothesis that Web3 innovation would extend beyond games to other areas such as entertainment and lifestyle.

For example, "STEPN" has rapidly expanded its user base by incorporating GameFi elements in the context of fitness and healthcare, which we considered when investing.

So, why focus on entertainment and lifestyle domains? There are three reasons.

First, while projects related to entertainment and lifestyle are not essential to life like finance, they enrich our lives.

Second, as I briefly mentioned in a previous newsletter, when I understood Axie Infinity's tokenomics, I became convinced that Web3 is indispensable for updating "money flows (fundraising and revenue distribution)" in creative activities, "team building" in creation, and "relationships between creators and fans."

Third, when a new technology like Web3 emerges, the killer applications that contribute most to mass adoption are consumer-oriented ones with gaming and social elements.

2. Primarily Asian Investment, Secondly North America

Next, let's discuss the investment regions. The pie chart below shows the regional ratio of Emoote's portfolio.

Web3 projects tend to operate remotely with a DAO-like structure, making it difficult to pinpoint a specific base location. However, we have categorized the areas based on where the project representatives are active.

Currently, Emoote is based in Singapore, covering Southeast Asia, East Asia, and India. The reason for choosing Singapore as a base is that we felt that Asia would become the epicenter of consumer-facing Web3 innovations, similar to Vietnam's Axie Infinity and the Philippines' Yield Guild Games (also known as YGG).

Below, we summarize the characteristics and outlook for each region.

2-a. Southeast Asia

While Southeast Asia has an underdeveloped financial infrastructure, there are opportunities in Web3. Play-to-Earn, which incorporates an "earning" element in games, gained attention in 2021, and we felt that the value of "earning" is relatively high in Southeast Asia. For this reason, we predict the emergence of entertainment and lifestyle projects that leverage "finance" in ways not seen in North America or East Asia, and Emoote will continue to invest in such projects.

2-b. East Asia

We focus on the "Entertainment × Web3" in East Asia, including Japan and South Korea. Needless to say, Tokyo and Seoul are world-renowned centers of entertainment. The culture that produces entertainment has historically been cultivated over time, and creators are rooted in it. No matter how innovative Web3 may be, it is difficult for other cities to overturn such culture in a few years. On the flip side, we believe that popular Web3 entertainment projects may be born in places where culture is already established, such as Tokyo and Seoul. Emoote is looking forward to encountering such projects.

2-c. North America (USA and Canada)

North America (USA and Canada) is also known for its resilience to change, and it is a region with a high potential for creating innovative platforms that quickly capture the world in a new era. Web3 is no exception. The Bay Area (San Francisco and Silicon Valley) is the world's largest tech city. Los Angeles is a world-renowned entertainment city with abundant talent and a high level of expertise. New York, Miami, and Texas also have strong communities. As Emoote, we will continue to invest in North American projects with different hypotheses from Asia.

2-d. Others

Of course, Web3 is a global movement, and we also look at other countries. Europe is strong and has several cultures. I know many world-class game companies were born in Europe. Middle East is growing with new talent, and I went there twice over the past year. Latin America has massive opportunities, same as South East Asia. Africa is future, and we already invested in three African projects.

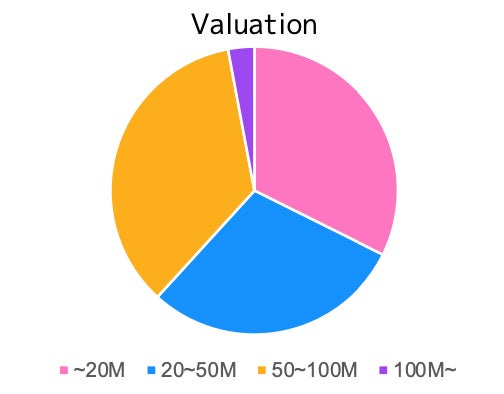

3. Seed Investment Strategy: Token and Equity Funding

Next, the investment stage proportions are as follows:

While market sentiment varies in Asia and North America, token rounds below $20M are considered pre-seed. There are also many first rounds starting at $30M, and if we assume $20-50M as seed, more than half of the investments are in the seed stage. We also cover middle-stage investments in the $50-100M range, such as private rounds for tokens. (Note that valuation guidelines differ for equity and tokens.)

Since its inception, Emoote has supported both tokens and equity (shares), with a track record of more token investments.

Digging deeper into "Why seed investments?", there are three reasons.

Firstly, especially for token projects, there are fewer fundraising rounds, and cases of rapid IEOs (Initial Exchange Offerings) are prominent. In other words, there are no Series B or later stages like in equity investments, so middle and late-stage investors miss out on opportunities. In the Web3 space, investors need to meet entrepreneurs(builders) and take risks earlier.

Secondly, in equity investments as well, seed lead investors (especially large VCs) often continue to lead and follow on with existing investors, increasing the importance of being a stakeholder from an early stage.

Thirdly, it's a matter of preference for funds and individuals. Taking risks before anyone else, deepening relationships with entrepreneurs, and providing continuous support for the longest time. Sharing both joys and sorrows. We want to experience the essence of being seed investors.

4. “STEPN Year”

If we describe our 2022 in one phrase, it would be the "STEPN Year." We learned so much through that investment.

We met the STEPN team and made an immediate investment decision a few months before their launchpad(listing) on Binance in March, and became known to everyone. An app that had only been officially launched a few months ago has achieved 3 million MAU, $120M in Q profits, and a fully diluted valuation of $20 billion. It's an incredible speed that is hard to believe.

Within just a few months, an initially unknown startup became known not only in the Web3 industry but also to the general public, causing a social phenomenon. We witnessed their achievements up close and learned about the potential of the industry and the power of tokenomics.

We learned a lot from their growth in areas such as game design, tokenomics, marketing, and bizdev. Based on these experiences, Emoote began supporting tokenomics design and operations for consumer projects in general from the second half of 2022.

Great investments, including STEPN, BreederDAO, etc, allowed us to build a broad network from global L1 blockchains to investors (VCs), enabling us to support fundraising, business development, marketing, PR, and hiring for our portfolio companies.

We believe that 2022 was a year that gave us the "entry ticket" to continue making aggressive global investments in 2023 and beyond.

On the other hand, GameFi projects like STEPN are sometimes derided as "Ponzi schemes" due to their low sustainability. When I attended international conferences, I was occasionally criticized by some participants who said, "Isn't STEPN a Ponzi scheme?"

One of my memories from 2022 is having a heated debate for over an hour with an entrepreneur from Southeast Asia whom I happened to meet at a conference in the US. In the end, we could not reach an agreement. However, I personally thought it was a great experience. Various people clash their opinions, incorporating their thoughts and beliefs into products and communities to prove them. Realizing that we are in the dawn of such an era made me excited.

While there are challenges, the impact that the STEPN team has had is significant, and I greatly respect them. After the fitness app, they launched a DEX (decentralized exchange) and an NFT marketplace. I look forward to the future of the STEPN team and ecosystem beyond 2023.

Web3 is so early, and we should go forward to build a new ecosystem through all experiences.

5. Embracing Web3: A Global Migration

I moved my base to Singapore and had a great challenge networking not only locally but also all over the world, focusing on Asia. With easy access to Southeast Asia and many resident investors, I believe Singapore is one of the best cities for entrepreneurs and investors to network.

In 2022, I visited the United States, Japan, South Korea, the United Kingdom (London), Portugal (Lisbon), UAE (Dubai), the Philippines, Vietnam, and India. While each city has its own culture, people involved in Web3 projects are all globally connected, meeting the same people at events and such. It was a year where I could experience the appeal of Web3, with local cultures and many people sharing common topics.

(I will omit the details, but) I considered moving to other cities, but ultimately decided to continue living in Singapore.

I often receive questions like, "Should I move abroad?" but there are as many ways to do it as there are people. For those interested, I have summarized the points and will tweet it in the future.

6. 2023: The Year to Build

As for the outlook beyond 2023, it is unclear whether the market will recover, and there may be a heavy atmosphere for a while. Huge projects may go bankrupt, token prices may be sluggish, and macro instability and Web3/crypto regulation may continue to cause anxiety.

However, it is precisely during such times that it is “Time to Build”. Opportunities will come to those who continue to believe and act. Fortunately, the Web3 ecosystem is steadily growing, with infrastructure improvements and an influx of talented people thanks to massive investments.

At the time of Emoote's establishment, we discussed all kinds of cases. At that time, we agreed to continue investing as long as the fundamental "hypothesis" about Web3 does not change, even if the market experiences a significant downturn.

Neither being overly optimistic nor pessimistic. Continuing to invest at our own pace. While simple, these are very difficult yet important things for investors. We have invested in over 30 projects at a pace of 2 per month so far, and we will continue to execute investments with an unchanged stance.

7. Japan's Web3 Projects: A World of Opportunity

Finally, what will happen to Japan's Web3 projects in the future?

For various reasons, there is no doubt that Japan has been lagging behind in Web3. On the other hand, legal and tax matters are steadily moving forward, one step at a time, thanks to positive discussions among the parties involved. There are also more cases of domestic IEOs (Initial Exchange Offerings) in Japan than before.

Web3-leading countries (projects) suffered significant losses in 2022 due to their early investments. In 2023, when these countries look back, it is a significant opportunity for Japan to catch up and surpass the world.

Japan has three strengths. First, the unique entertainment created by creators rooted in entertainment cities, as mentioned earlier. Second, the advanced technical capabilities that have been generated by catering to the high spending willingness of Japanese entertainment consumers. Third, the market size in terms of the large amount of money spent on "consumption" in Web3.

These strengths will be utilized in Web3 from now on. Without a doubt, in 2023, there will be a rapid increase in Web3 projects developed by Japanese people, in Japanese, and targeting the Japanese market.

We have expertise and networks from investing and supporting projects globally and insights from developing and operating entertainment and media services domestically and internationally at Akatsuki. We will make full use of these to boost Japanese projects through Emoote.

Rather than looking at 1-2 years, we believe in the future of Web3 that lies 5-10 years ahead, and even beyond. We look forward to meeting new builders today!

If you are considering starting a Web3 project or raising funds, please feel free to DM me on Twitter.

We tweet about the latest Web3 investment cases, tokenomics insights, overseas Web3 event information, and Singapore-related topics, so please follow me on my Substack and Twitter if you'd like:)

Twitter: https://twitter.com/yujikumagai

Emoote Website: https://emoote.com/