I’m a General Partner at "Emoote," a venture capital firm specializing in Web3. One of the most critical keywords in Emoote's current investment activities is "NFT."

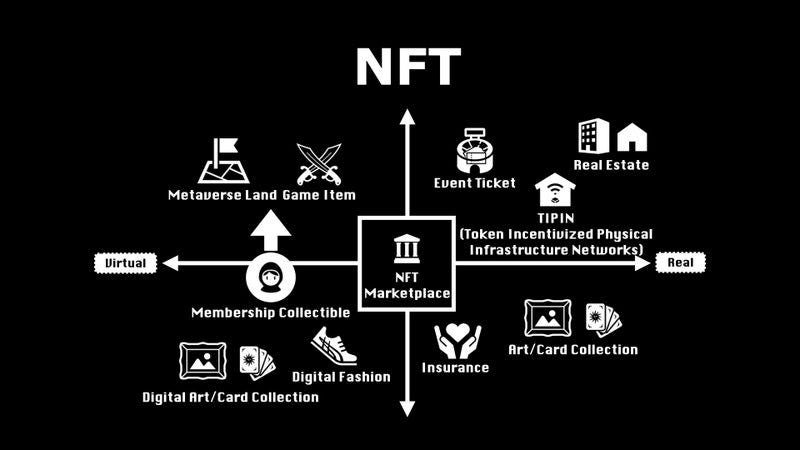

In a future where everything, whether virtual or real, from games, videos, music, comics and other forms of entertainment to real assets (RWA: Real World Assets) like real estate, is tokenized as NFTs, we're always pondering the needs of users and wondering what the next paradigm shift might be.

Within the ever-expanding NFT economy, I believe that NFT marketplaces have always been, and will continue to be, at the core.

In fact, the NFT marketplace has been the most volatile market in 2023.

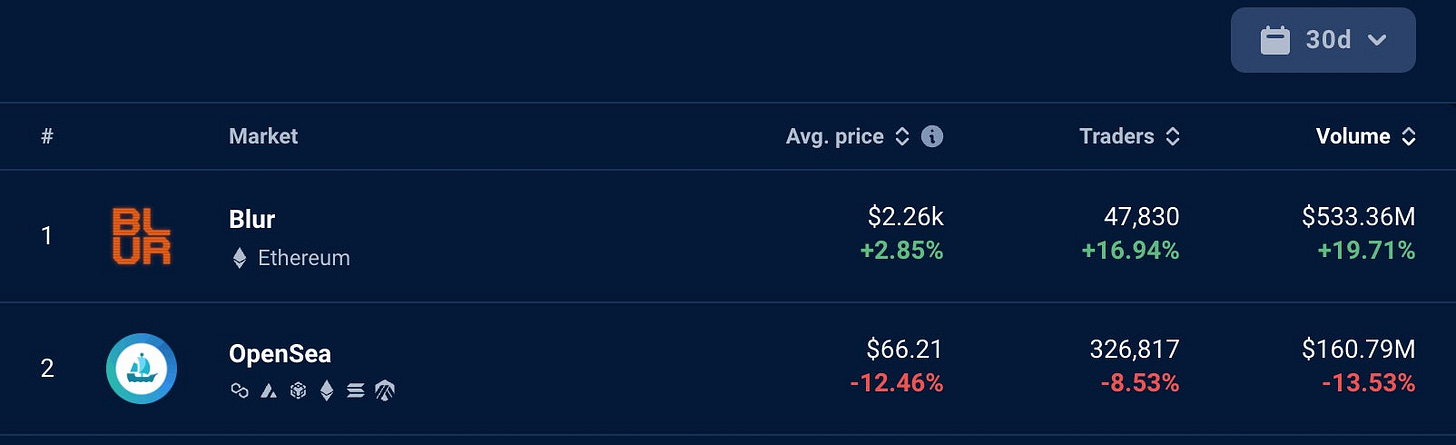

Emerging NFT marketplace "Blur" launched in the latter half of 2022, surpassing the world's largest trading volume held by "OpenSea" and securing the top spot in NFT marketplaces by March 2023.

While there have been occasional shifts in the top spot, the fact that "Blur" has maintained its lead for several months is quite surprising. Many in the Web3 industry probably thought, "Isn't OpenSea going to be the NFT marketplace leader forever?" Similar to how Google and Amazon seemed perpetually dominant in the Web2 era. That's what makes Web3 so fascinating.

There's a lot that Web3 builders can learn from the power struggles of NFT marketplaces. In this note, I'll look back at the history of NFT marketplaces, explore Blur's unique Web3 strategies, and venture to predict the future of NFTs.

Table of Contents:

Show All History of NFT Marketplaces

We'll revisit the history of NFT marketplaces, divided into three eras: (1) Dawn Era (2017-2020), (2) Rise Era (2020-2021), and (3) Revolution Era (2021-2023). By understanding this flow, we should better understand the "Future of NFTs."

(a) Dawn Era (2017-2020): Establishment of NFT Marketplaces During this period,

NFTs became a topic of conversation mainly in the crypto community, with crypto enthusiasts starting to acquire NFTs such as Cryptopunks, which remains a blue-chip today, and the game-type Crypto Kitties that allowed players to merge NFTs.

OpenSea: Standard

OpenSea, as mentioned earlier, was established in 2017. With the growth of the NFT market, it increased its transactions. In January 2022, it announced a $300 million fundraising at a $13.3 billion valuation led by Paradigm and Coatue. According to Crunchbase, it has raised a total of $427.2 million to date.

Backed by an overwhelming number of users, OpenSea has become the go-to when one thinks of NFT marketplaces. Many NFT projects actively utilize OpenSea during their launches, leading to a positive feedback loop of increased users.

Rarible: Standard (Competing with OpenSea) Type

Rarible, one of the popular marketplaces of its time, still ranks in the top 20 by trading volume. Back then, its intuitive and user-friendly UI was popular. I'm not fully aware of the detailed differences and transitions from 2017-18, but at a glance, its UI/UX looks quite similar to OpenSea's. A significant feature now is that it offers functionality akin to Shopify in e-commerce, allowing creators to establish their own NFT marketplaces.

SuperRare: Curated Type

A popular marketplace at its peak, but now outside the top 20. A significant feature is its curated NFT offerings. On its homepage, artworks that are harder to spot on OpenSea and similar platforms stand out. While curation is a common strategy for differentiation in vertical domains, compared to OpenSea, the number of artworks and users is limited, making it hard to scale transactions.

There are also platforms like async that allow for layer separation of NFTs, and KnownOrigin which is strong in curation like SuperRare. Notably, KnownOrigin was acquired by eBay in January 2022.

(2) NFT Boom Period (2020-2021) - Emergence of Proprietary NFT Marketplaces

This period saw the birth of services that triggered the spread of NFTs from crypto enthusiasts to the mainstream.

NBA Top Shot: Proprietary NFT Marketplace (Vertical Integration) Type 1

One such platform was "NBA Top Shot", launched in late 2020 and became a global sensation by early 2021 with aggressive promotion. Within a year of launch, it recorded sales of over $700 million.

The reasons for its popularity include, first and foremost, the use of the license from the globally renowned basketball league, the NBA. Additionally, sports trading cards are a familiar pastime and collection in the real world. The digital replication of this was easily understood by many, which significantly contributed to its appeal.

Axie Infinity: Proprietary Marketplace Type 2

Another platform is "Axie Infinity". While it launched in 2018, after several years of operation, it saw a significant boost in July 2021. Especially in the Philippines and Southeast Asia, the Play-to-Earn model resonated well with farmers and others affected by the pandemic.

Additionally, scholarship programs like YGG boosted the trend. Following the attention it received in July 2021, investors also began purchasing governance tokens and NFTs, recording sales of $1.3 billion in 2021 alone.

Platforms that achieved big hits in 2021, such as NBA Top Shot, Axie Infinity, and OpenSea, rarely made headlines together. The reason being that they were all focused on their proprietary NFT marketplaces. This marked a turning point in 2021.

Projects with strong content inevitably set up their proprietary marketplaces to maximize the user experience.

(3) Revolutionary Period (2021-2023) - From Token Incentive Model to the Emergence of Blur

In contrast to the proliferation of proprietary marketplaces during the boom period (2020-2021), the revolutionary period (2021-2023) witnesses emerging universal marketplaces challenging established players in true Web3 fashion.

LooksRare: Token Incentive Model

The first marketplace to attempt a "vampire attack" against OpenSea, setting its platform fees lower than OpenSea and incentivizing users with its native token $LOOKS, trying to poach users from OpenSea.

As the NFTs available on both platforms are the same, it's rational for users to choose LooksRare due to its monetary incentives. However, there was a high volume of "wash trading", and the received $LOOKS tokens were quickly sold, causing the token price to drop.

A "vampire attack" is a method where, using token incentives or financial advantages, one platform poaches users or liquidity from a competitor. The inception of this technique is often attributed to Sushiswap forking Uniswap and rewarding its users (liquidity providers) with its native token.

X2Y2: Enhanced Functionality + Token Incentive Model

Next came X2Y2, which also employed a "vampire attack" against OpenSea, not only offering its native token $X2Y2 as an incentive but also redistributing a portion of its platform sales as staking rewards to its token holders.

Unlike LooksRare, which mainly pushed monetary incentives, X2Y2 showcased superior development prowess, catering to the intrinsic motivations of NFT traders. For instance, while previously NFTs could only be listed or purchased individually, X2Y2 introduced bulk processing and launched a lending service where NFTs could be used as collateral. They crafted reasons for users to stick around even without monetary incentives.

However, as of July 2023, X2Y2 hasn't consistently surpassed OpenSea. Recent data from the last 30 days shows a nearly tenfold difference in transaction volume. Furthermore, there are reports indicating a higher rate of wash trading on X2Y2 compared to OpenSea and Blur, making its future growth uncertain.

sudoswap: AMM Model

Introduced in the latter half of 2022, sudoswap is an NFT's Automated Market Maker (AMM), a version of the NFT for what Uniswap has achieved with fungible tokens.

When compared to the order book model, it might seem complicated, but by providing a targeted NFT and Ether to a liquidity pool, trades are conducted automatically based on algorithms. While it attracted attention as the "NFT version of Uniswap", it hasn't been able to amass significant liquidity so far.

Blur: The All-Rounder Enter

"Blur", the reigning champion of the current NFT marketplace.

Launched in October 2022, Blur has been increasing its transactions ever since. From February to June 2023, it has consistently surpassed OpenSea in transaction volume, maintaining its top position.

Image: DappRadar "NFT Marketplace" "Why could Blur finally overtake OpenSea?" This will be a bit long, but I'll explain the three key points: "Zero commission rate," "Airdrop of their unique token $BLUR," and "The liquidity revolution through Bids."

Zero Commission Rate

Astoundingly, Blur has set its platform commission to zero. While OpenSea traditionally set its secondary market commission at 2.5% and its competitor LooksRare at 2.0%, Blur offers a 0% rate. This is extremely attractive for NFT traders.

This reminds us of the early 2000s when Google provided many free services like Google Analytics and Google Maps, overshadowing their competitors. Google was able to monetize through its search-based ad model. On the other hand, Blur might cover operating costs by selling its own tokens. By providing valuable services and issuing tokens to increase their market value, the project can sustain itself. Ultimately, they might aim for a fully decentralized DAO. (Generating revenue through additional business ventures could be their last resort.)

Issuing tokens seems to be a very effective move. It's not just a means of fundraising. Moreover, dismissing tokens as speculative and excluding them misses the point. Using tokens, we're building a world where we can operate businesses very differently from before. Blur is quintessentially Web3.

Airdrop of their unique token $BLUR

Another attractive feature is the airdrop of their unique token $BLUR. Right after launch, they conducted a "Season 1" airdrop campaign. Specifically, by purchasing NFTs on Blur, listing them, or bidding, you could qualify for the airdrop. In February 2023, the airdrop was executed, and some users earned amounts in the hundreds of millions of yen. This ignited the fire of Blur's popularity, consistently surpassing OpenSea as mentioned.

While LooksRare and X2Y2 also had airdrop campaigns, Blur's campaign felt exceptionally effective. Instead of awarding tokens with every transaction, users accumulated points. At the end of the campaign, based on these points, users received in-app Lootboxes. Upon opening these, users received $BLUR with a random element. This added gamification aspects, such as competition through rankings and entertainment through randomness, made it a much bigger topic than typical airdrop campaigns.

Liquidity Revolution through Bids

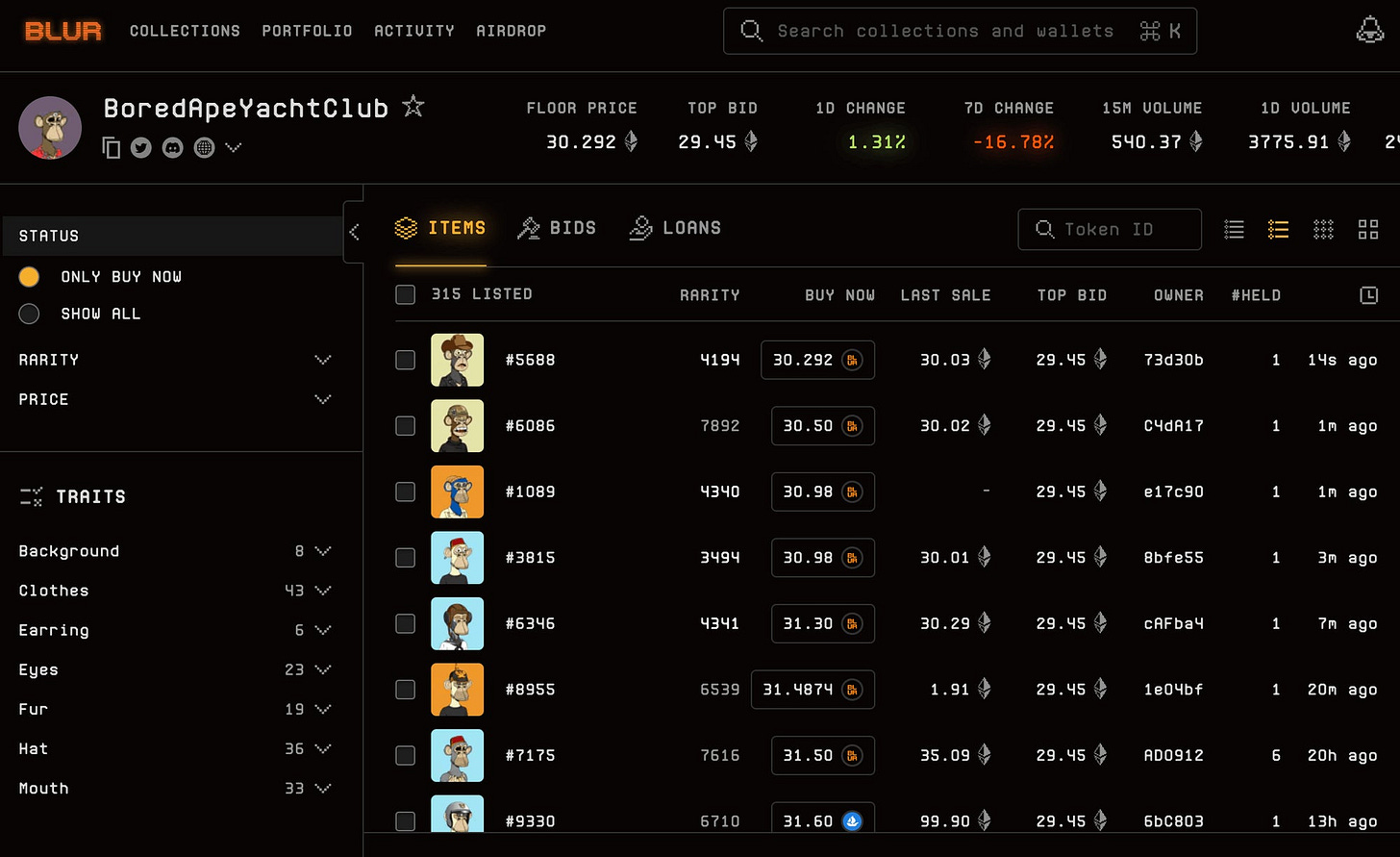

A major functional difference from other marketplaces is Blur's Bid feature. For collections like the Bored Ape Yacht Club, buyers can place bids, and sellers can instantly sell just by pressing the "Sell" button. This Bid feature, combined with an intuitive user experience, is what sets Blur apart. What happens then? Buyers are more likely to place lower bids in hopes of a better deal, while sellers looking to quickly convert their assets to cash turn to Blur's Bids. This increases the liquidity of NFTs on Blur, resulting in a liquidity revolution.

Initially, traders used Blur for external motivations (like avoiding fees or benefiting from airdrops), but over time, they began to appreciate the convenience of the Bid feature and increased liquidity, which became internal motivations. This transition from external to internal motivations is one of the attractive uses of Web3 that I envision. For more details on this, please refer to a previous note I wrote.

Why Japan has advantages in Web3

Despite the fluctuations in the cryptocurrency (token) market, the global Web3 movement shows no signs of stopping. According to data company CoinMarketCap, tokens worldwide have generated a value of 1.6 trillion dollars. The number of unique addresses for Ethereum, a representative protocol supporting the Web3 ecosystem, is approaching

In this way, I call the tokenomics, which multiplies emotional values like "fun/love > wanting to earn money", the "Emotional Economy". Why is this approach important? Users who initially came with the Extrinsic motivation of "wanting to earn" gradually become fans and develop feelings like "fun", "love", and "support". This is driven by Intrinsic motivation. If you visualize this on a graph, you get a certain image. (from the article above)

Besides the above user-centric attractions, there are other functional benefits like aggregation. Additionally, Blur's momentum doesn't seem to be stopping, with recent launches like the loan service "BLEND" making headlines.

Challenges Faced by Blur

Of course, Blur faces challenges. Here, I'll mention two: "Creator compensation" and "Wash trading". Blur very effectively leverages Web3 philosophy and functionalities, and closely observing their challenges offers a lot of learning opportunities.

Creator Compensation

Decisions Should be Made by the Creator Community Starting with creator compensation. Blur initially made royalties from secondary sales optional. Unfortunately, many traders chose a 0% rate. As a result, competitors adopted the optional model, breaking the ideal of creators receiving perpetual.

Here is the translation of the provided text:

"Afterwards, due to countermeasures from OpenSea and backlash from creators, Blur began to mandate a 0.5% creator commission. However, the issue has not been resolved. Various approaches, such as the development of on-chain contracts to enforce creator commissions, have been tried.

By the way, I personally have my eyes on Limit Break, the company behind 'DigiDaigaku', which is also addressing the 'creator commission' issue. I've summarized the details below for reference.

The Next Revolution in GameFi, "DigiDaigaku"

As a venture capitalist, I have executed investments in over 40 global Web3 projects, including STEPN. Given my experience, I am frequently asked, "What sector/project are you focusing on next?" If you ask me now, I would unequivocally say, "DigiDaigaku."

We at Emoote also believe that 'Web3 empowers creators', and invest and support every day, recognizing this as a significant issue. In all entertainment and media, creators are the source, and it goes without saying that it's essential to create an environment where they can work enthusiastically and receive adequate compensation.

The most important thing is that the creator community can make decisions. We will continue to work on improving the ecosystem, both voluntarily and through our investment projects.

Wash Trading: A healthy market can only be achieved by preventing cheats.

Another major issue with Blur is wash trading. As mentioned earlier, it refers to meaningless actions, such as trading between one's wallets with the purpose of an airdrop, or repeatedly making mechanical trades while being prepared to bear transaction fees. As a countermeasure, Blur excluded accounts deemed as involved in wash trading from airdrops, resulting in a lower but still present level of wash trading compared to platforms like LooksRare or X2Y2. In the past, trade volumes plummeted following the end of airdrop campaigns, and there is a possibility that volumes might drop below OpenSea if wash traders leave.

While it's difficult to precisely define wash trading, I've prepared some reference values for wash trading volumes that were publicly available on Dune. (Please note that these might vary based on research).

However, from observing the Discord of NFT collections I often follow, many users genuinely use Blur. Given the appeal of such users, it is anticipated that Blur will maintain a certain scale in the future.

Future Predictions for NFT Marketplaces: Five Keywords

The battle for NFT marketplaces has only just begun. In the next bull market, NFTs will expand even further, and there's a good chance new NFT marketplaces will emerge. I've brainstormed some ideas from the perspective of 'How to differentiate from existing players?'. I hope this serves as a reference when considering NFT-related projects, and provides a sense of where NFTs are headed.

'Unique Marketplaces': Harnessing overwhelming content as a weapon.

As mentioned, 'NBA Top Shot' and 'Axie Infinity' have leveraged their strong content to establish their own NFT marketplaces. In the future, various collections and games are expected to be incorporated. This trend started as early as the NFT boom period (2020-2021). Popular game portal 'Steam' started with strong game titles including Valve's Counter-Strike. Epic Games, needless to say, utilized FORTNITE to launch its own portal, 'Epic Store'. 'Content is King' remains timeless. If a new NFT game surpasses Axie Infinity and STEPN, it might become the foundation for expanding marketplaces and game portals."

"Category Specialized Type": PFP is just the beginning

Both OpenSea and Blur predominantly transact PFPs (Profile Pictures). Does this mean PFPs will continue to be the core of NFTs? I don't think so. The realm of entertainment, especially games, as well as RWAs (Real World Assets), will expand in this space. There is a high likelihood of emergence of category-specialized types or a transition towards a generic marketplace capturing these changes.

"Creator-First": The focus should be on the creators

As mentioned, there were issues related to creator remuneration concerning NFTs from 2022. A marketplace's long-term growth is unlikely if creators or the community reject it. Therefore, a creator-first designed marketplace might be plausible. Niche or curated types seem to have a better chance than generic ones.

"Mobile-Only (First)": Optimization of UX As of the end of July 2023, Blur isn't optimized for mobile (although it's gradually improving, it's unlikely to become mobile-first). This is one of their shortcomings. Before Web3, many services found opportunities by transitioning from PC to mobile optimization. In Japan, "Mercari" is probably the most famous example. As NFTs become more mainstream, a "Mobile-Only (First) NFT marketplace", considering user demographics and NFT types, is conceivable.

"White Label": From proprietary development to white labeling

Every NFT project, from collections to games, will start implementing marketplaces within their apps. The reason is simple: to maximize the user experience (UX). While there are projects like "NBA Top Shot" and "Axie Infinity" that develop proprietary platforms, not all will follow this route. We'll see multiple players offering white-labeled marketplace solutions. This can also address the creator remuneration issue as the project provider becomes the marketplace provider.

"Web3 Philosophy": Is there value to return to?

I believe one of the charms of Web3 is its "openness," "transparency," and "composability" in a decentralized, free environment. However, as every Web3 project grows, they seem to become more exclusive, looking to maximize short-term profits almost as if reverting to a pre-Web2 state. Decentralization may seem disadvantageous in the short term, but in the long run, maintaining Web3 values can lead to significant innovations involving creators and communities. NFT marketplaces have this potential.

In conclusion

We've revisited the history of NFT marketplaces, the revolution sparked by Blur, and speculated about the future of NFT marketplaces.

I am involved in shaping the future as a VC. I also assist as an advisor and incubator, supporting project planning, global Bizdev, tokenomics design, fundraising, etc. If you're inspired by this article and wish to venture into NFT marketplaces or related projects, please DM me. Let's create the future of digital content together, aspiring entrepreneurs!

I will continue to tweet updates on the latest Web3 projects, investment trends, tokenomics considerations, overseas Web3 event info, happenings in Singapore, etc., as I did in this note. If you like, please also follow my Substack and Twitter!